Untitled [gamma.app]

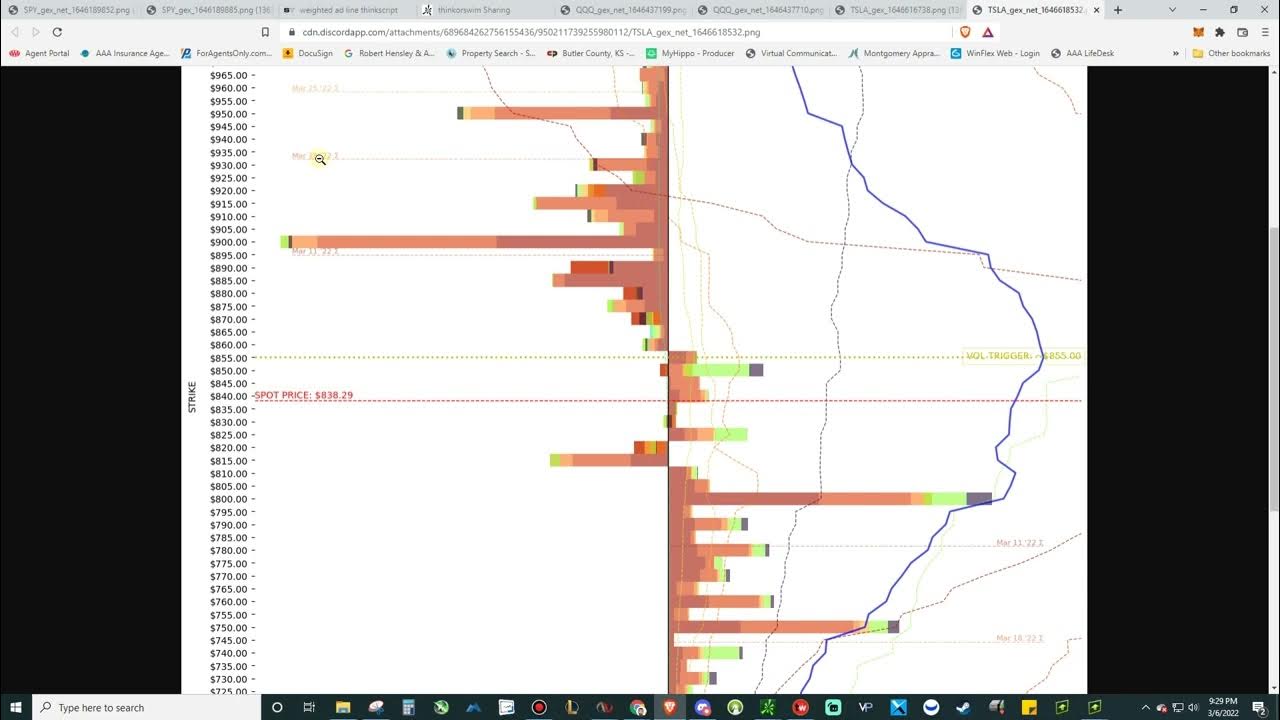

Chris Frewin · Follow Published in Option Screener · 8 min read · Feb 6, 2023 1 Source: one of our Vanna exposure charts. Author's Note: While we do reference spot price gamma as well as spot.

Untitled Gamma

Quick Answer: Gamma is a measure of the contrast between light and dark areas in an image. It is used to adjust the brightness, contrast, and color balance of digital images. What Is Gamma In Photography? Gamma in photography refers to the relationship between input and output values of an image.

Linear vs Gamma PBR workflows in Touch General TouchDesigner

Color Adjustments: Brightness, Contrast, and Gamma :: Blog. Orpalis is now part of PSPDFKit Orpalis is now part of PSPDFKit Learn more. About PSPDFKit. Today we are going to explain some terms related to color adjustments in digital images: brightness, contrast, and gamma.

What is gamma in option trading and more gbp eur exchange rate yahoo

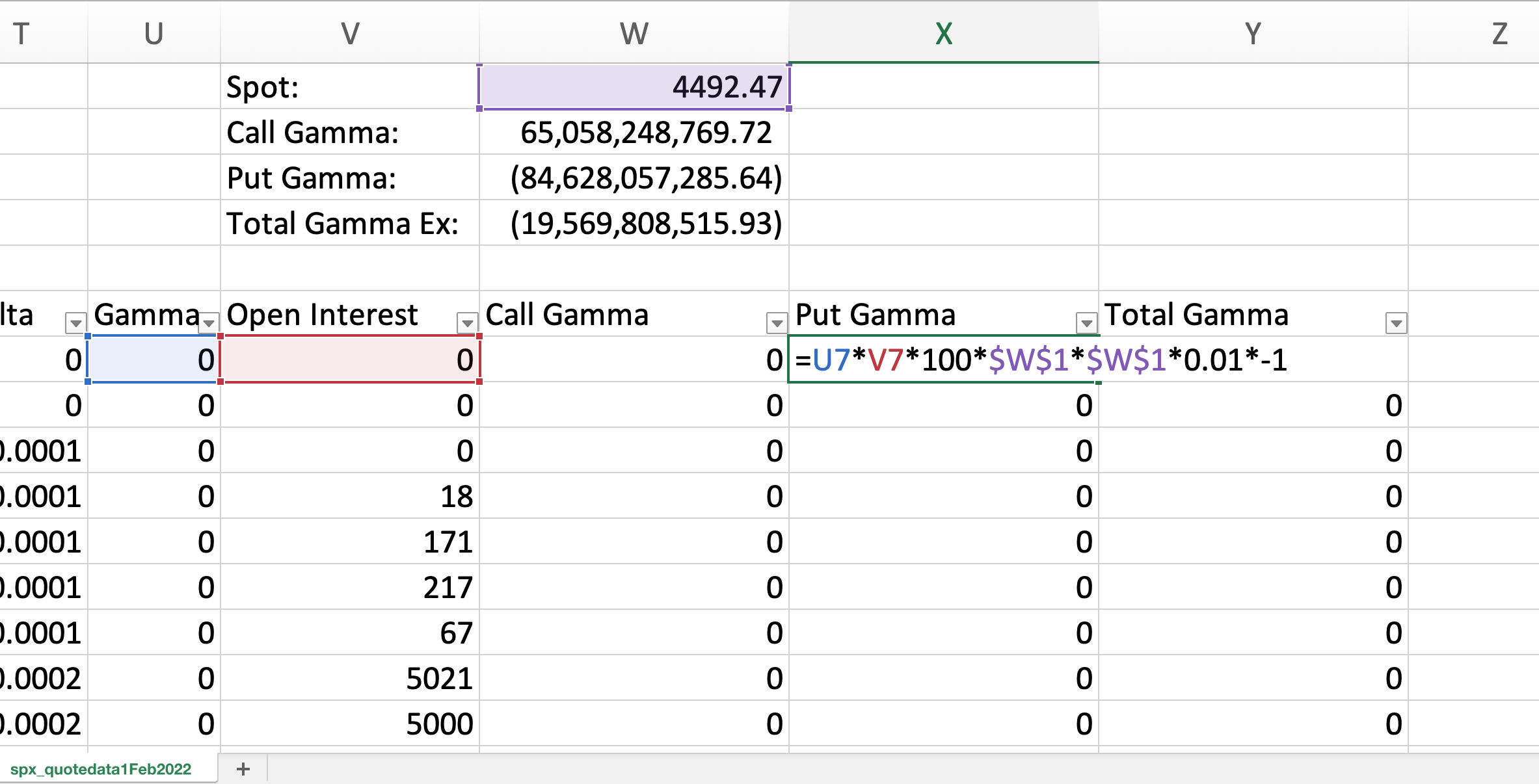

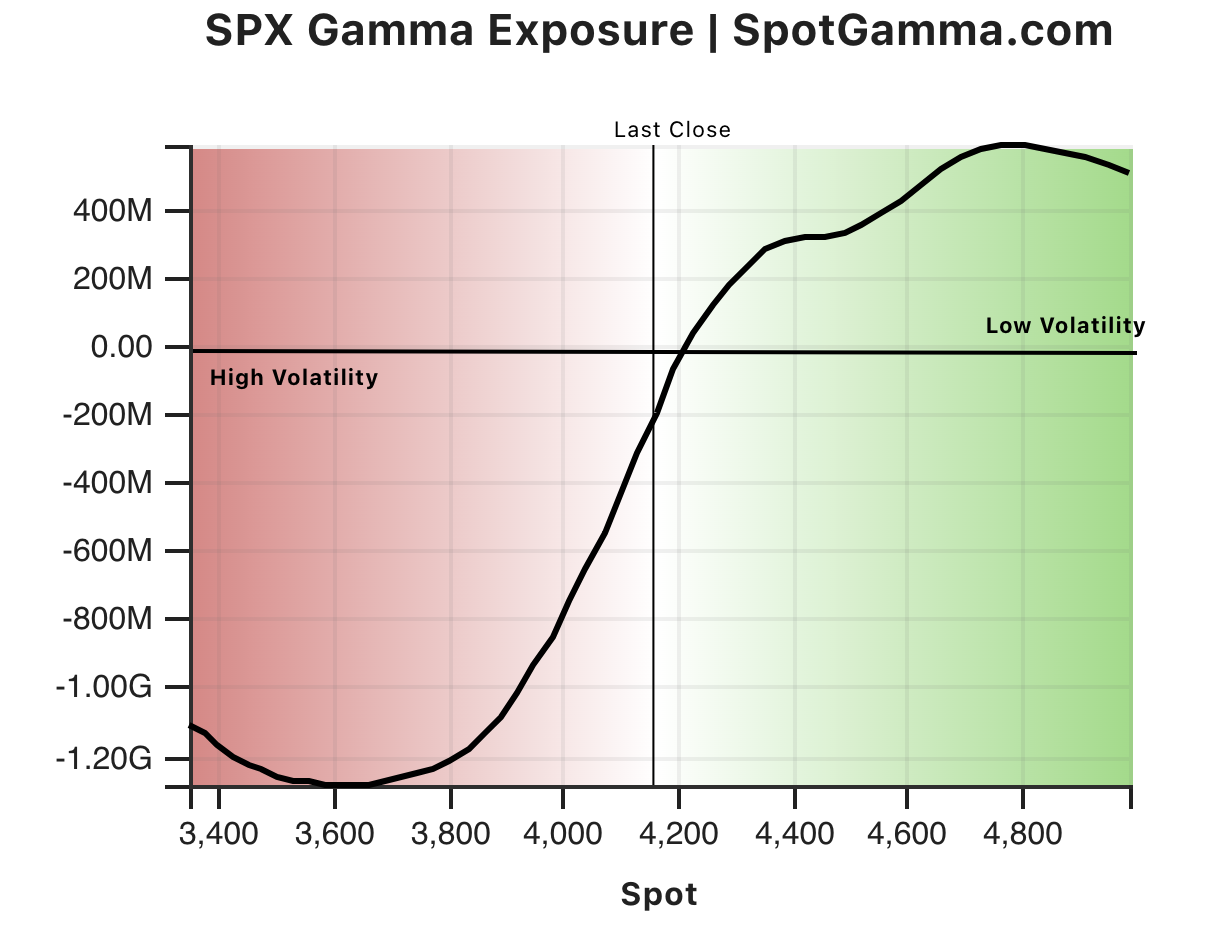

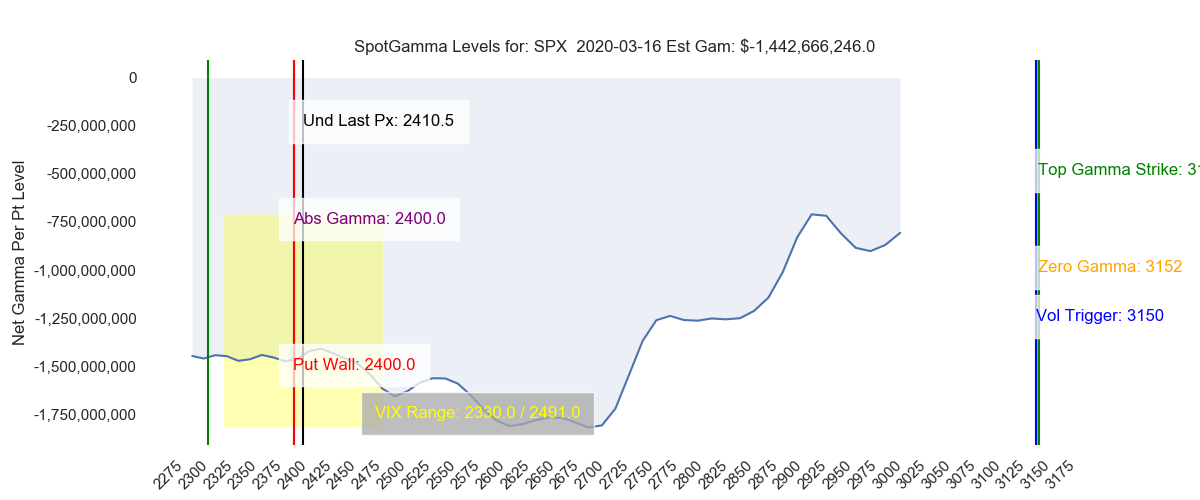

Gamma exposure, also known as dollar gamma, is a measure of the second-order price sensitivity of an option or portfolio to changes in the price of an underlying security. In mathematical terms, gamma exposure equals half the gamma of the portfolio multiplied by the square of the price of the underlying security.

How to Calculate Gamma Exposure (GEX) and Zero Gamma Level Perfiliev

Research, Options Education, Gamma and Gamma Exposure. Gamma and Gamma Exposure (GEX) are becoming increasingly important forces in today's market, and have the potential to become one of the most important non-fundamental flows in equity markets. As traders, we are always interested in developing and understanding new and persistent market.

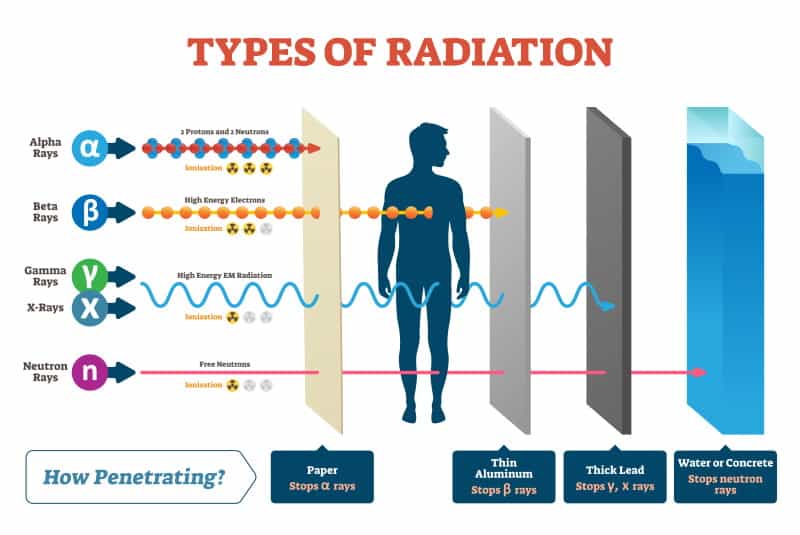

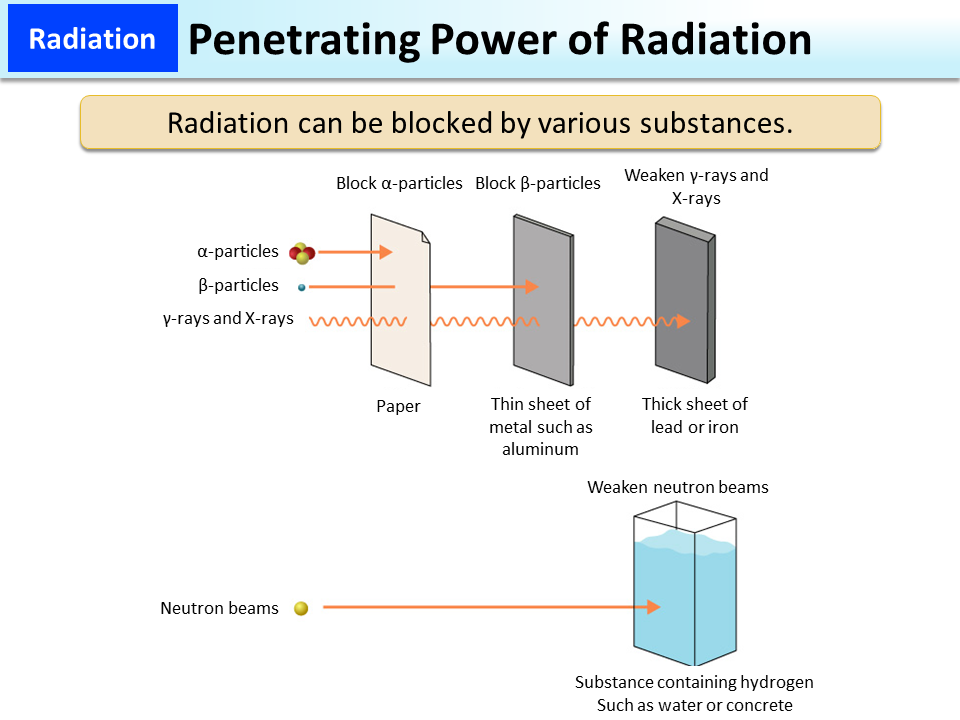

FAQ Radiation SONGS

Gamma Exposure is a crucial concept within the world of options trading and derivatives. It helps traders understand the sensitivity of an option's price to changes in the underlying asset's value. Since options are derivatives, their behavior is intrinsically linked to the fluctuations of the underlying assets.

How Far Do EMF Waves Travel?

Gamma correction is sometimes specified in terms of the encoding gamma that it aims to compensate for — not the actual gamma that is applied. For example, the actual gamma applied with a "gamma correction of 1.5" is often equal to 1/1.5, since a gamma of 1/1.5 cancels a gamma of 1.5 (1.5 * 1/1.5 = 1.0). A higher gamma correction value might.

Power of Radiation [MOE]

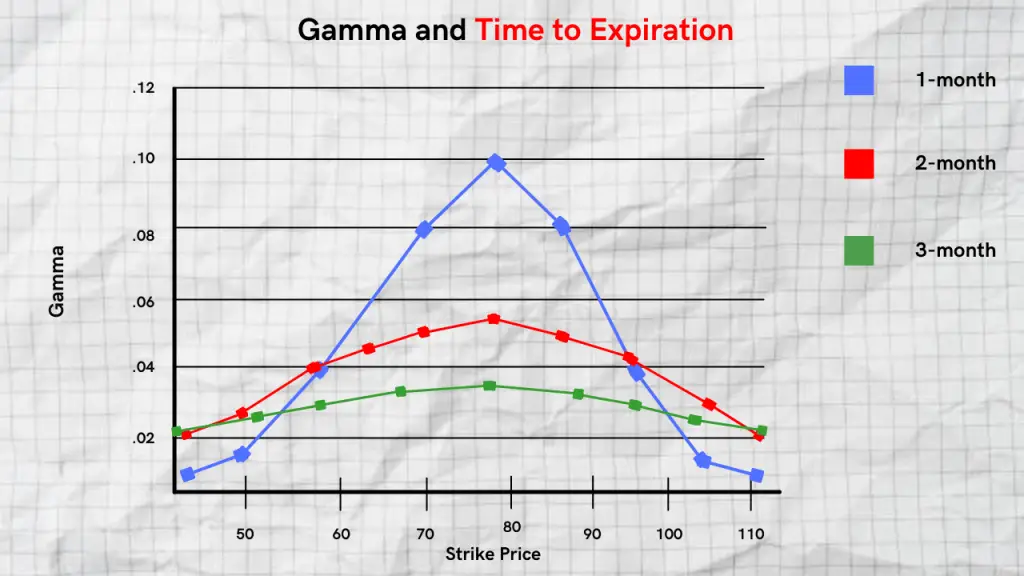

For the puts we multiply each by -1 as their gamma is negative. When we have them all calculated we add all the gamma with similar strikes together which would be the Total Gamma Exposure (GEX) for each strike. If you plot it it should look something like this. Total Gamma Exposure (GEX) vs. Strike Price

Gamma in Options Explained What is Gamma in Options?

Displays and gamma HDR and tone reproduction.. F-Number and exposure: Fstops: 1.4 2 2.8 4.0 5.6 8 11 16 22 32 45 64 1 stop doubles exposure f = f a N a CS148 Lecture 12 Pat Hanrahan, Winter 2007 HET= Camera Exposure Exposure Exposure overdetermined Aperture: f-stop - 1 stop doubles H

Free Gamma Exposure Chart SpotGamma™

Gamma Exposure (GEX) is a valuable tool for analyzing supply and demand in the options market. In this video, we'll review how gamma works and how we formula.

Option Expiration, Gamma Exposure and all the rest systematic

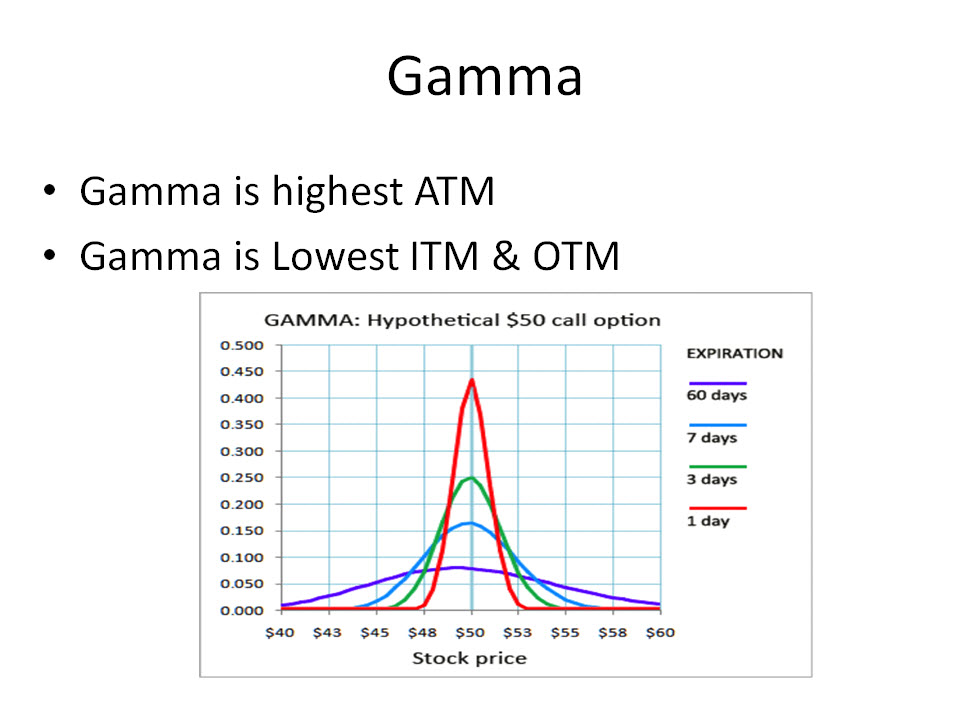

The passage of time. Gamma is the change in delta with respect to the underlying price. Vanna is the change in delta with respect to the implied volatility. Charm is the change in delta with respect to the passage of time.

Gamma in Options Explained What is Gamma in Options?

Gamma & Gamma Exposure are talked about a lot by retail traders these days. Everyone is actively trying to learn complexities of options, and leverage differ.

Intro to Gamma Exposure Charts and how to create your own gamma levels

Gamma refers to the change in an option's exposure to its underlying market as it moves from out-of-the-money to in-the-money, which can lead market participants to offset this change by trading the underlying shares.

21D DDOI Gamma Exposure for AMEXSPY by SPYvsGME — TradingView

Gamma correction or gamma is a nonlinear operation used to encode and decode luminance or tristimulus values in video or still image systems. [1] Gamma correction is, in the simplest cases, defined by the following power-law expression:

The Large 3/20 Options Expiration SpotGamma™

Too dark because it simulates CRT losses showing an image with no gamma, because now your LCD also decodes gamma 1 to gamma 0.45, also too dark. This is the effect of CRT gamma losses. CRT is why we use gamma correction. Center slider at 1.0, normal default, normal gamma 2.2.

What do you mean Gamma Exposure? systematic individual investor

When market makers are long gamma, they have positive gamma exposure, stabilizing the market by buying during price decreases and selling during price increases. Conversely, short gamma positions involve market makers buying during price increases and selling during price decreases, intensifying moves in the underlying asset.